The AOP Buyer Power Score is a new content offering created in partnership with ProcurementIQ that rates the balance of power between buyers and sellers for a particular spend category

Today we are reviewing the consumer credit reporting services category. Consumer credit reports contain objective information about a person’s credit history and can be used by insurance companies, lenders, and property managers.

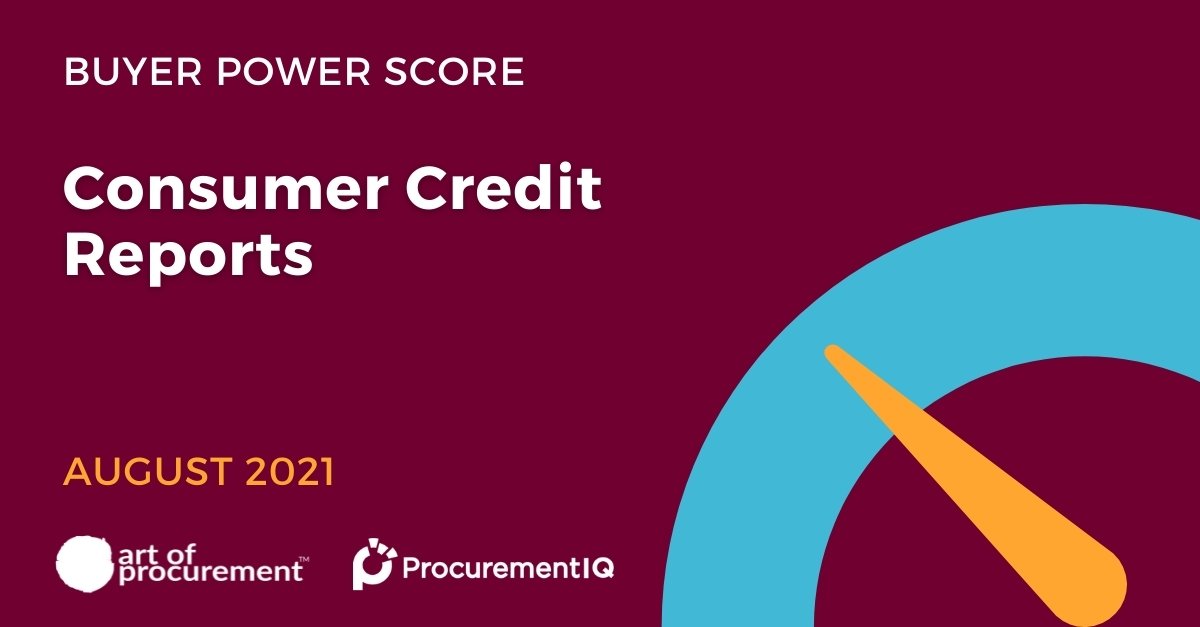

The Numbers

The current Buyer Power Score for consumer credit reports is 3.9 out of 5, indicating relatively high buyer leverage. Although supply risk and price volatility are both low, a few large suppliers have control over the majority of the market. Fortunately, the availability of comparable substitutes, even if there are not very many of them, allows procurement to switch providers and run a competitive bidding and negotiation process. Previous barriers to switching providers, which were related to the quality of data provided by each supplier, are no longer a major issue, increasing buyer power.

How to Use this Information

How to Use this Information

If your contract for consumer credit reports is approaching its expiration date, it is worth looking to see how many other providers are able to satisfy your requirements. Prices in this category have not been rising quickly year over year, and this is expected to continue through 2023. As long as your requirements can be met by another comparably sized provider, it is worth investigating the benefits associated with switching.

Dig Deeper

We have partnered with ProcurementIQ to dig into their treasure trove of over 1,000 indirect category intelligence reports, with new insights every Friday. To dig deeper into the Consumer Credit Reporting Services category, click here.